Bank Linking Network

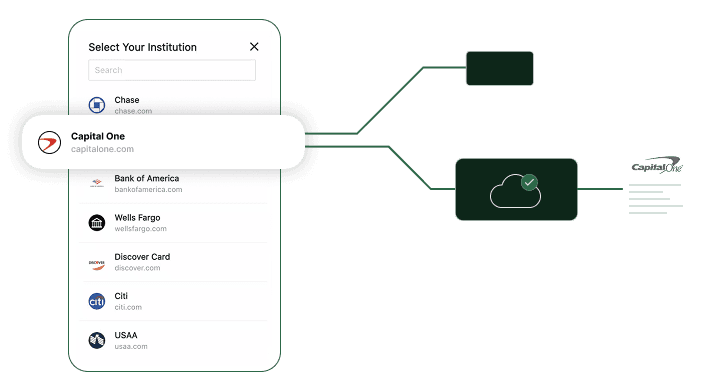

Bank Linking that actually works. Enable multiple Open Banking integrations through an integrated UI. Increase account connection and verification rates, build redundancy, and lower support inquiries and TCO.

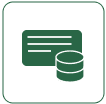

Supporting integrations across the ecosystem

Features and Benefits

Adding one additional provider increases coverage by over 5000 new institutions

Supporting multiple providers extends coverage to support your customers wherever they bank. By increasing institution coverage, developers broaden their customer TAM and increase conversion rates by 22%-45%.

Features and Benefits

Adding one additional provider increases coverage by over 5000 new institutions

Supporting multiple providers extends coverage to support your customers wherever they bank. By increasing institution coverage, developers broaden their customer TAM and increase conversion rates by 22%-45%.

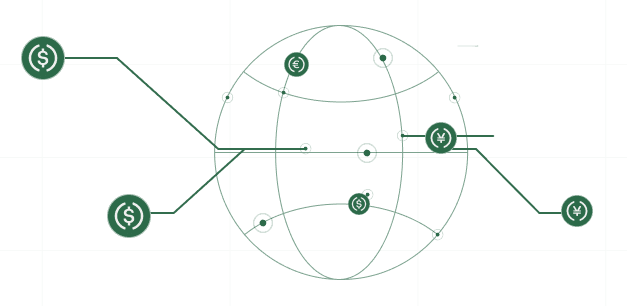

Add redundancy to your bank-linking connections

When a bank connection is unreliable with one provider, use another. Minimize disruption for your customer in their bank-linking flow and increase conversion rates.

Add redundancy to your bank-linking connections

When a bank connection is unreliable with one provider, use another. Minimize disruption for your customer in their bank-linking flow and increase conversion rates.

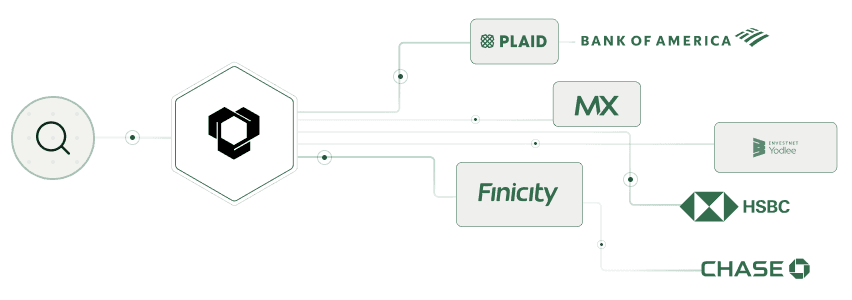

Integrated UI for customers and unified data model for developers.

Customers get the best experience out of the box. Developers scale across multiple providers with ease.

Integrated UI for customers and unified data model for developers.

Customers get the best experience out of the box. Developers scale across multiple providers with ease.

Regularly updated institution metadata.

Meld keeps an updated list of institutions so you don’t have to!

Regularly updated institution metadata.

Meld keeps an updated list of institutions so you don’t have to!

Use cases

Across Bank Linking experiences

Use cases

Across Bank Linking experiences

Account Verifications

Account Verifications lower the risks associated with ACH. Fintechs can use consumer permissioned bank data such as name, address, and routing and account numbers to power payment and verification flows. When a customer is unable to connect their bank information, you lose a critical opportunity to convert a willing prospect into a customer.

Account Verifications

Account Verifications lower the risks associated with ACH. Fintechs can use consumer permissioned bank data such as name, address, and routing and account numbers to power payment and verification flows. When a customer is unable to connect their bank information, you lose a critical opportunity to convert a willing prospect into a customer.

Underwriting

Lending, credit, and debit platforms need a customer’s bank transaction data to effectively power their underwriting models. By increasing institution coverage and providing better reliability, Meld increases data coverage in your models to unlock insights, lower your customer acquisition cost, and serve more customers.

Underwriting

Lending, credit, and debit platforms need a customer’s bank transaction data to effectively power their underwriting models. By increasing institution coverage and providing better reliability, Meld increases data coverage in your models to unlock insights, lower your customer acquisition cost, and serve more customers.

Budgeting

Budgeting applications want to provide 360 degree visibility into their customers’ finances. Working with Meld, they ensure they are able to support all of the institutions and accounts their customers want to connect to provide holistic financial advice.

Budgeting

Budgeting applications want to provide 360 degree visibility into their customers’ finances. Working with Meld, they ensure they are able to support all of the institutions and accounts their customers want to connect to provide holistic financial advice.